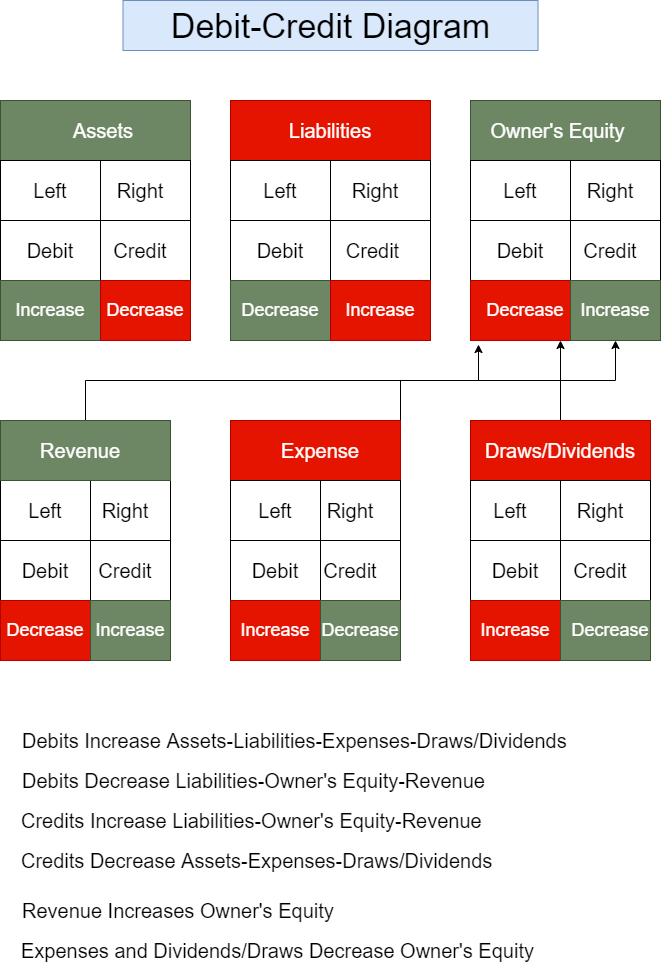

The normal balance of a contra account can be a debit balance or a credit balanceĮxamples of contra account: Accounts receivable is an asset account that normally has a debit balance. Normal balance: Always opposite to the relevant normal account. Rule: An increase is recorded on the credit side and a decrease is recorded on the debit side of all equity accounts. Rule: An increase is recorded on the credit side and a decrease is recorded on the debit side of all revenue accounts. Rule: An increase is recorded on the credit side and a decrease is recorded on the debit side of all liability accounts. Rule: An increase is recorded on the debit side and a decrease is recorded on the credit side of all expense accounts. Rule: An increase is recorded on the debit side and a decrease is recorded on the credit side of all asset accounts. The basic rules of debit and credit applicable to various classifications of accounts are listed below: (1). Application of the rules of debit and credit The normal balance of a contra account (discussed later in this article) is always opposite to the main account to which the particular contra account relates. The normal balance of all asset and expense accounts is debit where as the normal balance of all liabilities, and equity (or capital) accounts is credit. If, on the other hand, the normal balance of an account is credit, we shall record any increase in that account on the credit side and any decrease on the debit side. If the normal balance of an account is debit, we shall record any increase in that account on the debit side and any decrease on the credit side. The understanding of normal balance of accounts helps understand the rules of debit and credit easily. The answer lies in the learning of normal balances of accounts and the rules of debit and credit. Now the question is that on which side the increase or decrease in an account is to be recorded. As stated earlier, every ledger account has a debit side and a credit side. The increase in machinery and decrease in cash must be recorded in the machinery account and the cash account respectively. For example, purchase of machinery for cash is a financial transaction that increases machinery and decreases cash because machinery comes in and cash goes out of the business. When a financial transaction occurs, it affects at least two accounts. In the rest of this discussion, we shall use the terms debit and credit rather than left and right. In practice, the term debit is denoted by “Dr” and the term credit is denoted by “Cr”. The left hand side is commonly referred to as debit side and the right hand side is commonly referred to as credit side.

Let’s see in detail what these fundamental rules are and how they work while a business entity maintains and updates its accounting records under a double entry system.Ī ledger account (also known as T-account) consists of two sides – a left hand side and a right hand side. The rules of debit and credit determine how a change affected by a financial transaction can be updated in a journal and then applied to accounts in ledger. In accounting, a change in financial position essentially signifies an increase or decrease in the balances of two or more accounts or financial statement items. In article business transaction, we have explained that an event can be journalized as a valid financial transaction only when it explicitly changes the financial position of an entity. The debit and credit rules are the heart of accounting and their understanding is extremely important for individuals who are responsible for handling the accounting system of a business entity. Since the accounting cycle starts with a journal comprising of debit and credit entries, the use of a double entry accounting is not possible without strict adherence to these rules. The rules of debit and credit (also referred to as golden rules of accounting) are the fundamental principles of modern double entry accounting that guide accountants and bookkeepers in journalizing financial transactions and updating ledger accounts of a business entity. Application of rules of debit and credit.

0 kommentar(er)

0 kommentar(er)